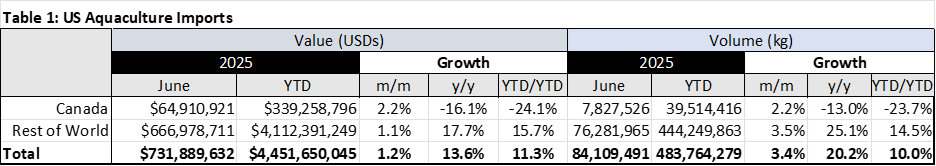

Aquaculture is now the backbone of the global seafood trade, and the United States—the world’s largest seafood importer—relies heavily on farmed products to meet its demand. In July 2025, the US imported US$2.3 million in aquaculture products, a decrease of 4.6% from the previous month, with all major suppliers posting negative growth including: Chile (-6.7%), Norway (-1.9%), Canada (-4.3%) and the UK (-3.3%). In volume terms, US imports were flat (+0.1%), indicating the weakness was on price, not demand.

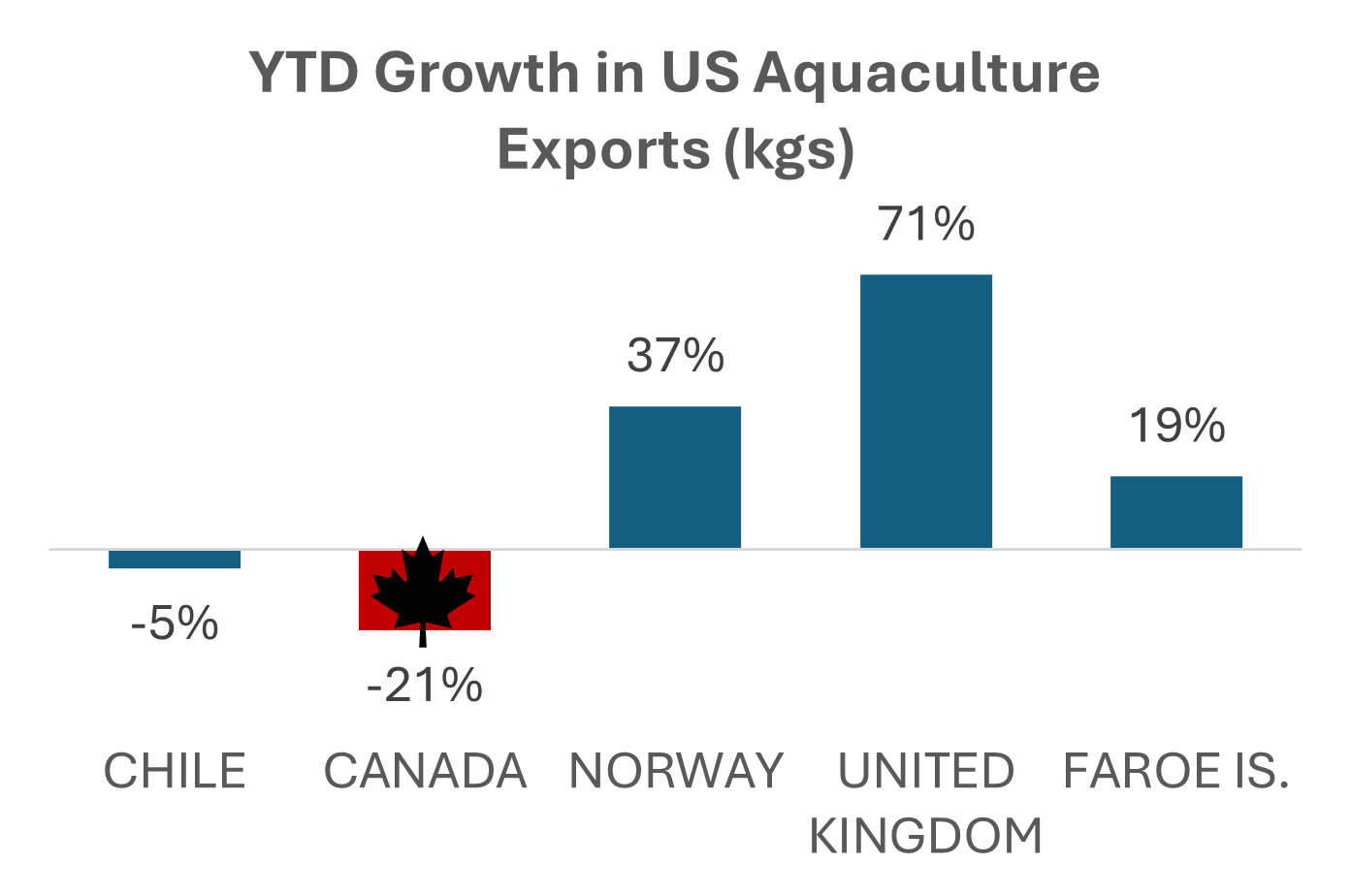

For the year-to-date (January-July), US imports of farmed seafood reached over US$2.3 billion, down -5% from the same period last year of US$2.46 billion. In volume terms, imports year-to-date are up 0.4%. The headline numbers, however, mask vast differences in the performance of top exporting countries. Canada, one of the top exporters of aquaculture products to the US, has seen a drop in exports of -21% compared to +37% for Norway and +71% for the UK.

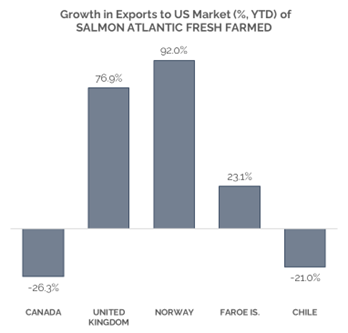

The difference in growth rates is particularly stark as aquaculture exports from both Norway and the UK into the US face tariffs, while Canada’s aquaculture exports, which are CUSMA compliant, face no tariffs to the US.

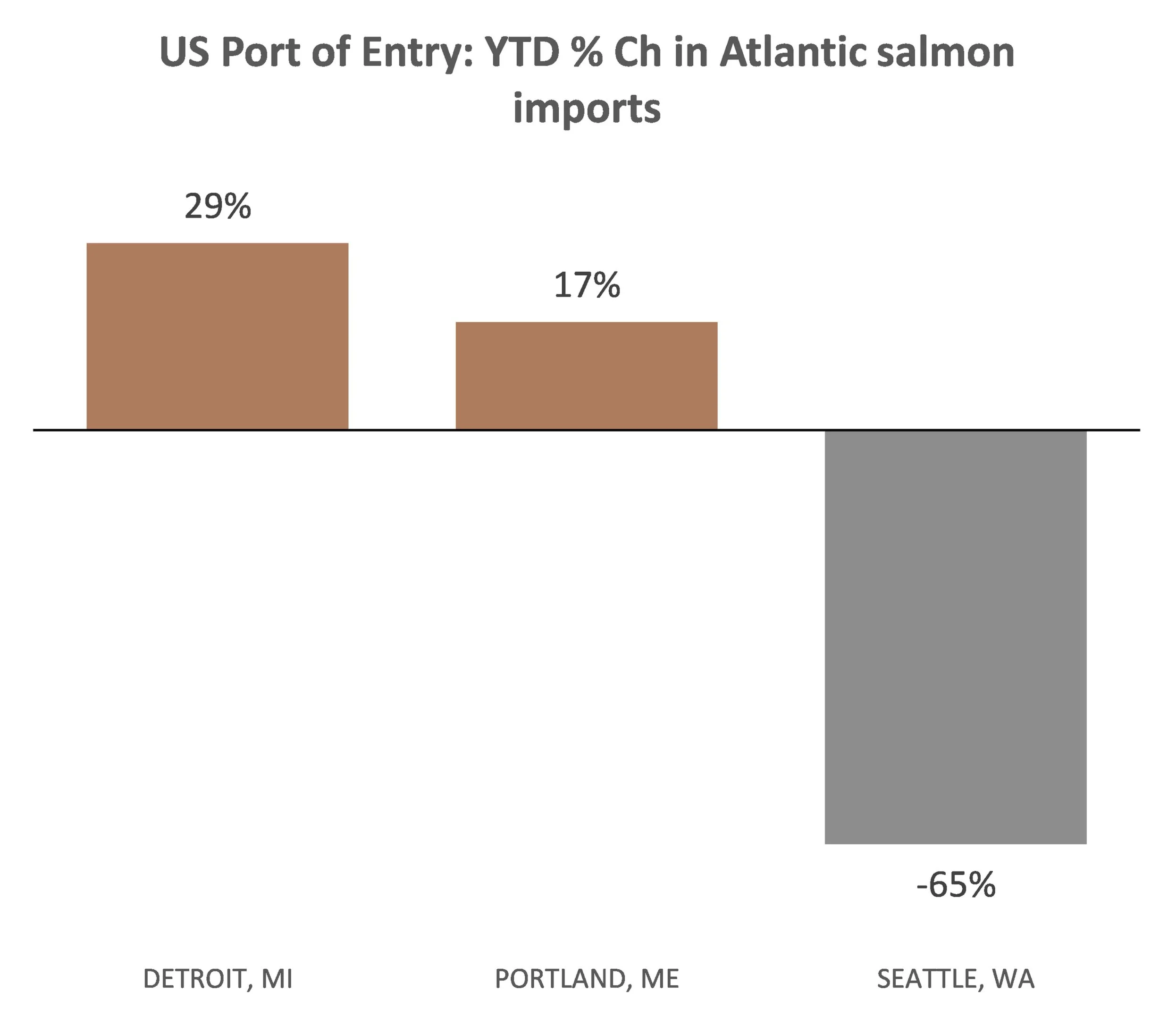

The weakness in Canadian aquaculture exports is broad-based, with almost all species (except Rainbow Trout) posting negative growth so far in 2025. Fresh Atlantic Salmon – Canada’s largest aquaculture export product- is driving the losses, with a decline in volume shipments of 23% through July. Visit CAIA’s trade dashboard to explore product details [link].

Domestic policy, not trade war, key concern for the sector

Canadian aquaculture exports enjoy tariff-free access to the US market, a competitive advantage compared to key competitors, namely Norway –subject to 15% on all US exports – and the UK, with a 10% tariff rate. The sector also welcomed the August 22, 2025 announcement that Canada was removing most of the retaliatory tariffs, which had been temporarily reprieved earlier in the year, and impacted key supply chains, primarily in the feed sector.

Salmon farm closures in British Columbia are the key driver of Canada’s falling production and export profile. For Canadian shellfish farmers, a lack of regulatory capacity is seen as a major constraint in BC and biological challenges are facing growers in Atlantic Canada.

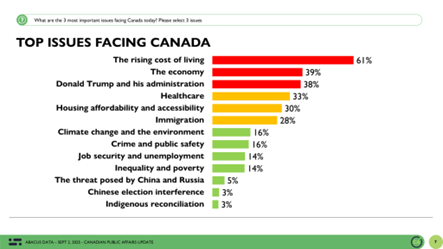

Inflation top concern for Canadians, while grocery prices continue to rise

The rising cost of living is now the most important issue for Canadians (chart below from Abacus data, September 2, 2025). While headline inflation slowed in July, (1.7% y/y down from 1.9% in June), the price of food rose at a faster pace in July (+3.4%) compared with June (+2.8%). According to Statistics Canada, as of July 2025 Canadians are paying 27.1% more for food purchased from stores than they were in July 2020 (source).

Meanwhile, economic conditions are deteriorating. The Canadian economy contracted in the second quarter, with a decline of -0.4% in real GDP. Many of the indicators of household economic conditions also worsened – including falling household savings rates, slow wage growth and rising unemployment (now at 7.1%). With economic conditions deteriorating and food costs accelerating, a renewed focus on supporting domestic food production is needed, now more than ever.

The Canadian aquaculture sector has the potential to produce more food in a sustainable way. The ‘Canada’ brand is strong – around the world and in Canada: the world wants more Canadian farmed seafood.