April was a good month for Canadian farm-raised seafood exports to the US, with sales jumping 21% in volume terms (+17% in value) over March levels; however, this boost still leaves Canadian exports down 27% year-to-date (Jan-April) over the same period last year. Atlantic salmon (fresh, whole fish) is the largest product category for the sector, historically accounting for almost 80% of aquaculture exports. The US trade data reports a jump in imports of Canadian farm-raised salmon, up almost 25% over March levels, while year-to-date (Jan-April) remains 32% lower than import volumes over the same period last year. Canada’s primary export product is fresh farmed whole fish, which accounted for 90% of Canadian Atlantic salmon exports to the US last year.

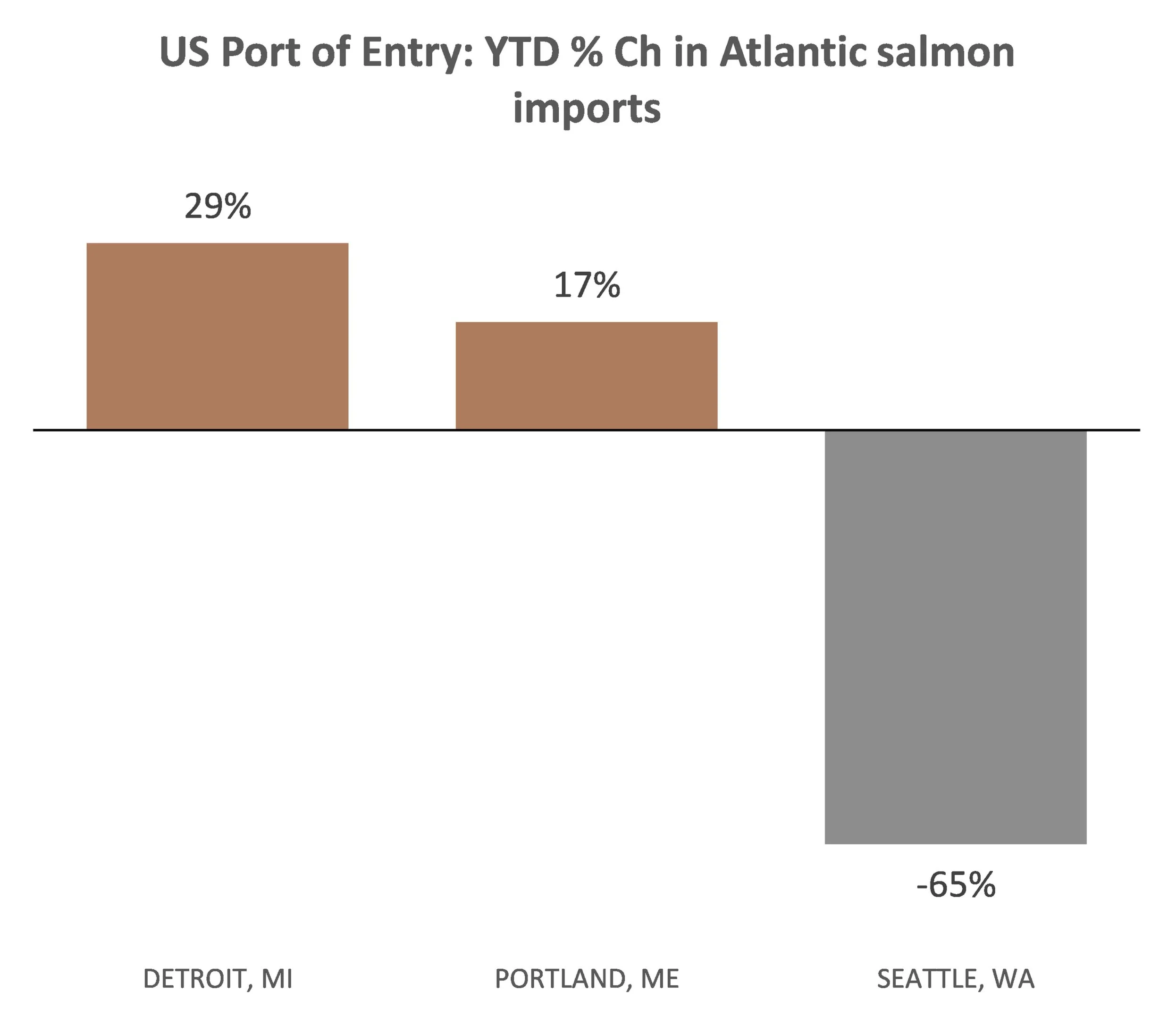

To better understand the trade profile, and the strength in US sales of Canadian-grown Atlantic salmon, it is helpful to look at the data by port-of entry. Canadian exports of Atlantic salmon enter the US through three ports of entry: Seattle WA (~60%, historically), Portland ME (~35%) and Detroit MI (~5%). In the first four month of 2023, there has been strong growth in US exports through Portland ME (+17%) and Detroit (+29%); Canadian exports through Seattle have plummeted 65% so far this year. This is the lowest volume of exports of Atlantic salmon from the West Coast since the late 1990’s. Up until last year, Atlantic salmon was British Columbia’s top agri-food export product and the tenth largest export category overall. It now does not make the list of top 25.

Please visit our website to see CAIA’s trade flash dashboard where you can view more details on Canada’s exports to the US by specific farmed product.